- Joule — Energy, Commodities, Finance

- Posts

- Chaos in the Middle East, economic policy, and predicting the future

Chaos in the Middle East, economic policy, and predicting the future

Topic 1: Chaos in the Middle East

A mainstream paper – albeit more liberal than the ruling party – is drawing an unequivocal link between Netanyahu’s policies and the presently unfolding catastrophe. Politicisation of the judiciary and military intelligence and corruption have had pernicious impacts on Israel’s defence posture, and a prolonged game of hot potato is inevitable. Fundamentally, a more moderate Israeli government must destroy Hamas and support a meaningful two state solution. How this will be accomplished is less obvious, as this is likely not in the best interests of any specific government in the region.

Topic 2: Macro, Finance, Oil

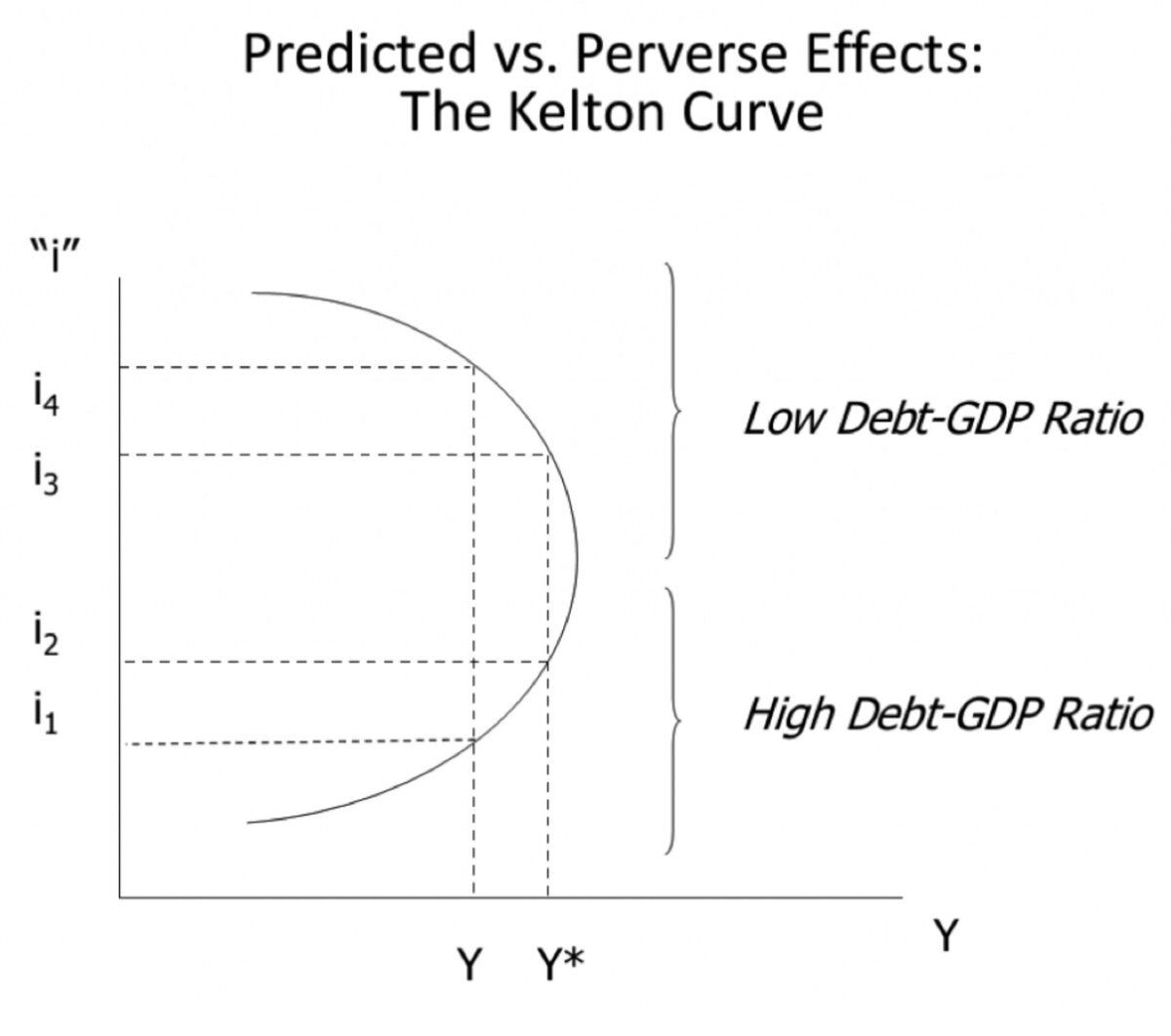

“Rising interest rates are currently having a limited negative impact on businesses and consumers as a whole. For many, it’s actually been a net positive.” More income to federal debt holders or corporates sitting on cash = more money that can be spent thanks to unintentional rate arbitraging. Stephanie Kelton presents an alternative view on the inflationary impacts of rate changes – i.e. the current environment might be stoking a strong economy, not taming it.

From a more micro perspective, the curve seems to hold for companies at different stages of corporate development – startups and energy transition firms with debt-financed expansion will be struggling to stay afloat, while your S&P500 type firms will be coasting on their strong balance sheets. This suggests that the current macro environment is good for the “wrong” kinds of firms, and there are perverse incentives at play that will hinder the long-term green agenda.

The bright side of higher interest rates (TKer)

EM average yield currently at near 12%, 828bps over Treasuries, and currency losses vs. USD ranging from 5% in Ethiopia to 57% in Argentina. Mr. Powell, tear down your rates!

Distressed Debt Anxiety Is Spreading Across Emerging Markets (Bloomberg)

Flat crude prices plummeted ~$10/bbl last week on the back of 1. Macro demand concerns and 2. Liquidated long positions.The calendar spread has obviously narrowed given the collapse in spot prices, but the market remains backwardated. Spot prices seem to be driven by Iranian supply concerns more than demand collapse, which is weighing on long-term prices.

TradingView

Gasoline markets have been struggling for most of this year, and while diesel/gasoil cracks remain elevated, they have declined slightly presumably on the back of macro risk factors. Gasoline stockpiles likely to continue building, and overall price profile likely to continue declining despite the Israel-Palestine conflict causing supply uncertainty. OPEC+ supply cuts may continue to push demand down, but unsure how this will sustain at sub-$90/bbl prices.

Topic 3: Energy transition & metals

Miners are becoming more bearish about how markets will support upstream spending for the energy transition. South African miners have all been downgraded, and long-term supply for many metals including Cu, Zn, and PGMs are at risk due to restricted capex. Permitting timelines, declining ore grades, and high WACC are all bearing down on the potential of new mines for energy metals, whether base or precious. Secondary supply and brownfield projects will become increasingly important, and developing better ways to close the loop on metals will be a dominant theme going forward.

At the same time, ESG concerns are becoming an increasingly important factor in which mining projects are realised. Indonesia is, and will remain, the dominant nickel supplier, but how much of this is actually threatened by investors’ ESG worries? In the longer run, the Ni market is expected to remain oversupplied due to a huge number of nickel pig iron conversion projects coming on in Indonesia. Will environmental externalities get properly priced when planned projects inevitably start being reconsidered?

Nickel miners linked to devastation of Indonesian forests (FT)

Investor interest in thematic funds related to energy transition & metals remains reasonably strong, and this raise has doubled Appian’s AUM.

Metal Trader Misery Undercuts Supercycle Hype Amid Losses (Bloomberg)

Traders not making money just means there isn’t sufficient volatility to be captured, not that the trend is fundamentally weak. High cost of capital, even for major players like Trafi and Glencore with $2b facilities, will influence value-at-risk decisions especially in light of fraud cases.

There is a disconnect in capital allocation strategies – the players with the most funds to throw around are not those with long-term investment horizons. Government institutions like DOE LPO and SWFs like the Saudi PIF are uniquely positioned to encourage new projects for both up and midstream, but I don’t believe that these institutions currently have a coherent strategy to join disparate industry segments.

Miscellaneous

As a child, I was a big fan of the idea that knowing the state of every present variable in a system would mean that you were able to predict the next state, and so on. Studying stochasticity and chaos dynamics has obviously put that to rest, but the idea of better understanding what the future might look like remains a pervasive theme in my work. Despite being mildly entertained by Aella’s tweets about rationalism, I remain unconvinced that surveys conducted among a self-selecting populace of techbros in their 20s is a useful way to form a view of the future. The Delphi method, with adjustments to include non-subject matter expert view, is surely more useful?

As Samuelson put it, “The stock market has predicted nine of the past five recessions.”

The Wager That Betting Can Change the World (NYT)

Comments, feedback etc. encouraged as always.